Latest Job Opportunities in India

Discover top job listings and career opportunities across India. Stay updated with the latest openings in IT, government, and more.

Check Out Jobs!Read More

🔥 When you expect job publications market movements: Use data as an investment signal

revealed

Survey the Job Board doctor: Get it too late.

Your voice matters more than you know.

the Survey the annual employment sites of the Job Board It is your chance to form the future of our industry, influence how platforms develop, and to ensure that the real needs of workboards are listened to loudly and clearly.

It takes only a few minutes, but the ideas we collect for strategies, standards and conversations that will be determined next year. Don’t sit on this one – click on your view and help us write a story of what the next employment is.

👉 Survey link: https://www.surveymonkey.com/r/g6nzp97

Foreths of market movements prediction: Data employment as an investment signal

A monthly guest post: Michael Woodro, Head Aspen Technology Labs, Inc.

For investors, the edge often comes from market discovery signals that have not yet been priced. One sign comes from a source that is often ignored: Using data.

The job jobs, which were collected directly from the company’s actual job sites, provides a window in corporate strategies before detecting them in profit calls or SEC files.

The increase in sudden employment can indicate expansion, contract win or launching new products. On the contrary, a decrease in vacancies may indicate a decrease in cost, poor demand, or workers’ layoffs. I have noticed hedge funds and financial institutions.

Neudata Reports indicating that more than 90 percent of the institutional data buyers expect to maintain or increase spending on alternative data groups until 2025, with many allocating 5 million dollars annually.

In the broader labor market in the United States, job jobs in August increased by only 0.2 % throughout the month but are still 2.5 % lower than last year, reflecting employers’ caution amid economic uncertainty.

At the same time, traditional data sources such as the work statistics office have been subjected to a political fire.

the next President Trump rejected BLS Commissioner In August, the agency reported the first monthly job losses in more than four years and unemployment to 4.3 %. Economists refer to customs tariffs, strict immigration policies, and demobilization of workers in the public sector as major engines.

In exchange for this background, ASPEN Tech’s vacant data provides a more stable lens in manpower’s directions. Unlike late official reports, employment signals reveal transformations in companies’ request to talent when they happen, which makes them invaluable for each of the investors and job boards.

Looking at the company’s level patterns, the predictive power of employment activity becomes more clear.

Trends between public companies and clients show how employment activity can be reliably predicted by financial performance.

Bose Allen Hamilton

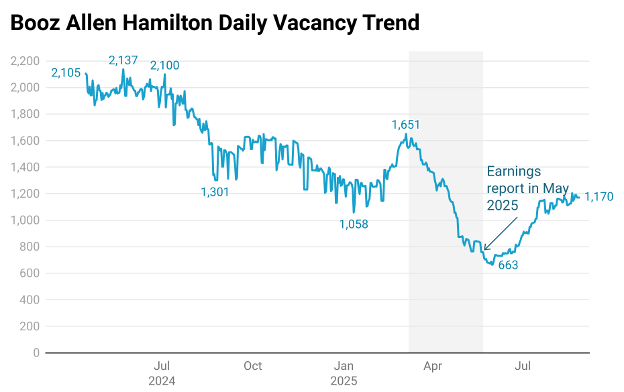

Take Bose Allen Hamilton (New York Stock Exchange: Bah) For example: Investors were eliminated by 16.5 percent decrease in the share prices in May 2025 after the profits and soft expectations of 2026. The company also announced the demobilization of workers amid efforts to reduce federal costs. However, the warning signs were there months ago. Booz Allen’s job leaflets from March 2025 peaks with more than 1,600 openings slightly higher than 700 before the profit date, decreased by 66 percent on an annual basis. This type of contraction in the demand for talent usually precedes the opposite winds of revenue. Investors could have been tracked to expect disappointing profits and adapted accordingly.

Figure 1: The Daily vacancies direction, Bouz Allen Hamilton

Huntington Ingalos

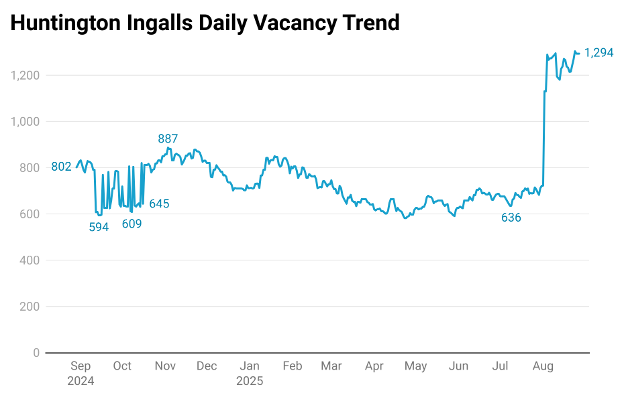

A completely different image appears in Huntington Engels (New York Stock Exchange: HII)The largest construction of military ships in the United States. Here, the employment direction reveals a rapid expansion in line with the increase in the prices of the last arrow. Since early August, job leaflets have increased by about 80 percent, with strong demand for engineers, cybersecurity and data scientists. The shares increased by 41 percent on an annual basis, reflecting the company’s victories and operational momentum.

Figure 2: Huntington Infagle direction for daily vacancies

Conversation

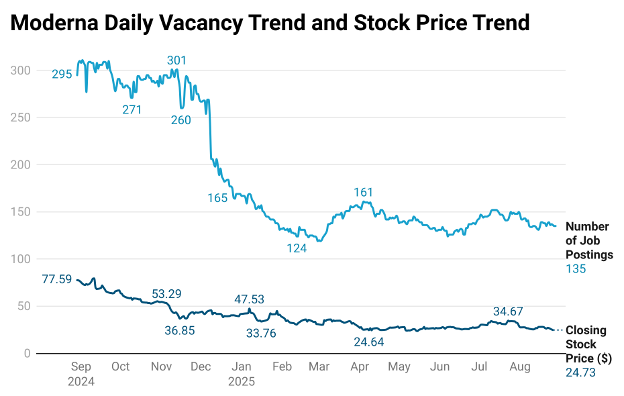

Perhaps the link between job publications and stock performance is more surprising Moderna (Nasdaq: Mrna). During the past year, biotechnology publications decreased by more than half, while the price of its share in Lockstep decreased, a decrease of 68 percent. The correlation between the two directions reached 0.86, indicating the extent to which vacant vacancies are performed. Moderna later confirmed weakness with workers’ demobilization, which affects 10 percent of their global working power, noting that the demand for vaccines has decreased and new products are worrying. Investors who watched the vacancies data could have been expected before the official ads.

Figure 3: Moderana daily vacancies and the stock price direction

Coruv

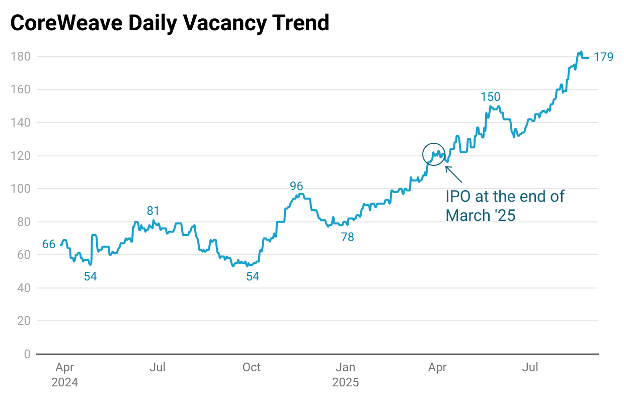

Employment data also provides cash visions for companies preparing for the public. Coreweave (Nasdaq: CRWV) It is an ideal example. In the year before the public subscription in March 2025, the company has almost doubled jobs, a clear indication of aggressive expansion. After the list, the vacancies rose up, and the stock has since increased by 144 percent, with the support of the growth of three -number revenues. RAMP TeleGRAPHER employed a growth story before confirming the deposits.

Figure 4: The direction of daily vacancies in Korif

Circle Internet Group

Circle Internet Group (NYSE: CRCL) It follows a similar pattern. Vacancies increased by 45 percent in the six months before the public subscription in June 2025, indicating that a public market expansion company. Public subscription price at $ 31 per share, and it raises $ 1.1 billion with a rating of $ 6.9 billion. Since then, stocks have risen 39 percent. For investors who are watching, the accumulation of fixed vacancies was a clear indication that Sirkel was preparing for the first time in the market.

Figure 5: Daily vacancies circle

Claarna

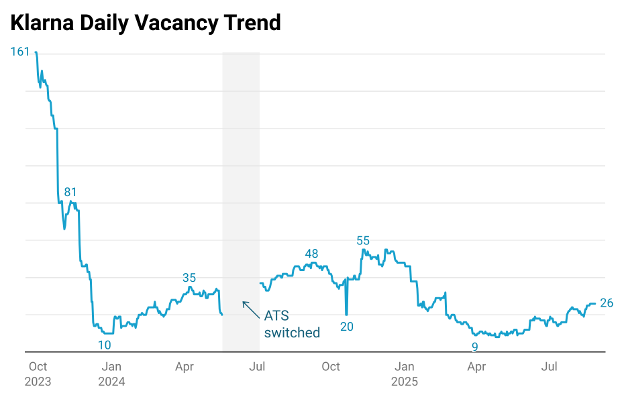

In contrast to that, Klarana (nyse: kla)With the public subscription scheduling on September 10, he tells a warning story. Once its value amounted to approximately $ 50 billion, the company sharply reduced its functions from more than 150 in 2023 to only 20-30 until 2025. Reuters She stated that Clarna plans to include her in the United States with a rate of $ 13-14 billion dollars less than its highest levels. Here, job leaflets indicated a deliberate shift in the strategy and the re -domination of expectations.

Figure 6: Claarna direction for daily vacancies

conclusion

The unrest about the work statistics office emphasizes the reason why markets need in a timely manner and worthy of the intelligence of work outside government reports. In September, the agency issued significant reviews of previous job reports that confirmed weaker growth than it initially mentioned. these Main reviews The ongoing political controversy highlights a broader problem: the official data arrives late, and is reviewed, and is subject to external pressure.

Aspen Tech Labs fill that gap. By picking up millions of publications directly from the company’s professional sites, ASPEN provides a set of high -quality data in actual time that investors and job boards can work immediately. This is not just a measure of human resources, but rather an aspirational financial signal that reveals expansion, deflation and preparation of public subscription a long time before profit calls or SEC files. In an environment in which confidence in government data fades, access to the intelligence of accurate employment in time is no longer optional; It is a critical feature.

Michael Woodro Head of Aspen Tech Labs, Inc. | Healthcare Data Analytics, Inc.

(Do you want to get the posts of the Job Board of Jobs via email? Subscribe here))

(Do you have advice, document, or Intel you want to share with DOC? Tell me.)

Responsibility: This information is provided for general information only and should not be considered personal financial advice.

Related

👉 Read more at: Read Now

Explore more: #expect #job #publications #market #movements #data #investment #signal

📰 Published by New JobBoard Doctor on 2025-09-11 18:59:00

Source Feed: Job Board Doctor

🌟 When you expect job publications market movements: Use data as an investment signal

explained

Survey the Job Board doctor: Get it too late.

Survey the Job Board doctor: Get it too late.

Your voice matters more than you know.

the Survey the annual employment sites of the Job Board It is your chance to form the future of our industry, influence how platforms develop, and to ensure that the real needs of workboards are listened to loudly and clearly.

It takes only a few minutes, but the ideas we collect for strategies, standards and conversations that will be determined next year. Don’t sit on this one – click on your view and help us write a story of what the next employment is.

👉 Survey link: https://www.surveymonkey.com/r/g6nzp97

Foreths of market movements prediction: Data employment as an investment signal

A monthly guest post: Michael Woodro, Head Aspen Technology Labs, Inc.

For investors, the edge often comes from market discovery signals that have not yet been priced. One sign comes from a source that is often ignored: Using data.

The job jobs, which were collected directly from the company’s actual job sites, provides a window in corporate strategies before detecting them in profit calls or SEC files.

The increase in sudden employment can indicate expansion, contract win or launching new products. On the contrary, a decrease in vacancies may indicate a decrease in cost, poor demand, or workers’ layoffs. I have noticed hedge funds and financial institutions.

Neudata Reports indicating that more than 90 percent of the institutional data buyers expect to maintain or increase spending on alternative data groups until 2025, with many allocating 5 million dollars annually.

In the broader labor market in the United States, job jobs in August increased by only 0.2 % throughout the month but are still 2.5 % lower than last year, reflecting employers’ caution amid economic uncertainty.

At the same time, traditional data sources such as the work statistics office have been subjected to a political fire.

the next President Trump rejected BLS Commissioner In August, the agency reported the first monthly job losses in more than four years and unemployment to 4.3 %. Economists refer to customs tariffs, strict immigration policies, and demobilization of workers in the public sector as major engines.

In exchange for this background, ASPEN Tech’s vacant data provides a more stable lens in manpower’s directions. Unlike late official reports, employment signals reveal transformations in companies’ request to talent when they happen, which makes them invaluable for each of the investors and job boards.

Looking at the company’s level patterns, the predictive power of employment activity becomes more clear.

Trends between public companies and clients show how employment activity can be reliably predicted by financial performance.

Bose Allen Hamilton

Take Bose Allen Hamilton (New York Stock Exchange: Bah) For example: Investors were eliminated by 16.5 percent decrease in the share prices in May 2025 after the profits and soft expectations of 2026. The company also announced the demobilization of workers amid efforts to reduce federal costs. However, the warning signs were there months ago. Booz Allen’s job leaflets from March 2025 peaks with more than 1,600 openings slightly higher than 700 before the profit date, decreased by 66 percent on an annual basis. This type of contraction in the demand for talent usually precedes the opposite winds of revenue. Investors could have been tracked to expect disappointing profits and adapted accordingly.

Figure 1: The Daily vacancies direction, Bouz Allen Hamilton

Huntington Ingalos

A completely different image appears in Huntington Engels (New York Stock Exchange: HII)The largest construction of military ships in the United States. Here, the employment direction reveals a rapid expansion in line with the increase in the prices of the last arrow. Since early August, job leaflets have increased by about 80 percent, with strong demand for engineers, cybersecurity and data scientists. The shares increased by 41 percent on an annual basis, reflecting the company’s victories and operational momentum.

Figure 2: Huntington Infagle direction for daily vacancies

Conversation

Perhaps the link between job publications and stock performance is more surprising Moderna (Nasdaq: Mrna). During the past year, biotechnology publications decreased by more than half, while the price of its share in Lockstep decreased, a decrease of 68 percent. The correlation between the two directions reached 0.86, indicating the extent to which vacant vacancies are performed. Moderna later confirmed weakness with workers’ demobilization, which affects 10 percent of their global working power, noting that the demand for vaccines has decreased and new products are worrying. Investors who watched the vacancies data could have been expected before the official ads.

Figure 3: Moderana daily vacancies and the stock price direction

Coruv

Employment data also provides cash visions for companies preparing for the public. Coreweave (Nasdaq: CRWV) It is an ideal example. In the year before the public subscription in March 2025, the company has almost doubled jobs, a clear indication of aggressive expansion. After the list, the vacancies rose up, and the stock has since increased by 144 percent, with the support of the growth of three -number revenues. RAMP TeleGRAPHER employed a growth story before confirming the deposits.

Figure 4: The direction of daily vacancies in Korif

Circle Internet Group

Circle Internet Group (NYSE: CRCL) It follows a similar pattern. Vacancies increased by 45 percent in the six months before the public subscription in June 2025, indicating that a public market expansion company. Public subscription price at $ 31 per share, and it raises $ 1.1 billion with a rating of $ 6.9 billion. Since then, stocks have risen 39 percent. For investors who are watching, the accumulation of fixed vacancies was a clear indication that Sirkel was preparing for the first time in the market.

Figure 5: Daily vacancies circle

Claarna

In contrast to that, Klarana (nyse: kla)With the public subscription scheduling on September 10, he tells a warning story. Once its value amounted to approximately $ 50 billion, the company sharply reduced its functions from more than 150 in 2023 to only 20-30 until 2025. Reuters She stated that Clarna plans to include her in the United States with a rate of $ 13-14 billion dollars less than its highest levels. Here, job leaflets indicated a deliberate shift in the strategy and the re -domination of expectations.

Figure 6: Claarna direction for daily vacancies

conclusion

The unrest about the work statistics office emphasizes the reason why markets need in a timely manner and worthy of the intelligence of work outside government reports. In September, the agency issued significant reviews of previous job reports that confirmed weaker growth than it initially mentioned. these Main reviews The ongoing political controversy highlights a broader problem: the official data arrives late, and is reviewed, and is subject to external pressure.

Aspen Tech Labs fill that gap. By picking up millions of publications directly from the company’s professional sites, ASPEN provides a set of high -quality data in actual time that investors and job boards can work immediately. This is not just a measure of human resources, but rather an aspirational financial signal that reveals expansion, deflation and preparation of public subscription a long time before profit calls or SEC files. In an environment in which confidence in government data fades, access to the intelligence of accurate employment in time is no longer optional; It is a critical feature.

Michael Woodro Head of Aspen Tech Labs, Inc. | Healthcare Data Analytics, Inc.

(Do you want to get the posts of the Job Board of Jobs via email? Subscribe here))

(Do you have advice, document, or Intel you want to share with DOC? Tell me.)

Responsibility: This information is provided for general information only and should not be considered personal financial advice.

Related

👉 Read more at: Read Now

Hashtags: #expect #job #publications #market #movements #data #investment #signal

Written by New JobBoard Doctor on 2025-09-11 18:59:00

Via Job Board Doctor